Out-of-Control US Federal Spending Needs to be Stopped Now!

The federal appropriations process needs to be fixed before it's too late

For all the heat and light associated with electing Kevin McCarthy as the new Republican Speaker of the House back in January, the deal-making only addressed symptoms of the problems, not the root causes.

Consider the symptoms of one of the major problems that has plagued the US for decades: out-of-control federal spending, as highlighted by the symptoms of massive spending bills that defy regular order, congressional earmarks, endless continuing resolutions, no federal budgets, and omnibus bills that fund leftwing Democrat spending priorities and include non-spending atrocities (such as gun control provisions).

What did the Mexican standoff between the Freedom Caucus and the GOP establishment Republicans accomplish to rectify out-of-control federal spending? While most of the media attention was on the motion to vacate, in which a single member of the GOP caucus could initiate the process for removing Kevin McCarthy (R-CA) from the speakership, there was a glimmer of hope that agreed-upon changes to the budget process on the rules might finally beginning to lasso the raging spending bull by forcing individual votes on each of the 12 appropriations bills that are bundled in the recently passed Consolidated Appropriations Act, 2023, prohibiting consideration of bills and joint resolutions that would require an increase in the debt ceiling, and restoring points of order against net increase in budget authority for amendments to general appropriations bills and against budget reconciliation directives that increase net direct spending, as noted here.

Another debt-related rule change made is to “restore the requirement that the Congressional Budget Office and Joint Committee on Taxation, to the extent practicable, incorporate the macroeconomic effects of major legislation into the official cost estimates used for enforcing the budget resolution and other rules of the House.” The Democrats didn’t care about long term effects of their profligate spending on the US economy.

While these are good changes in the House rules, the next Democrat-controlled Congress can revert to the existing rules that accelerate deficit spending. There was no commitment made to deal with root causes of runaway spending, and no real structural change to the appropriations process other than a few promises.

APPROPRIATIONS, THE BUDGET, AND IMPOUNDMENT

During the first 70 years of the twentieth century, the only time the federal budget wasn’t balanced was during an economic downturn or during wartime. Americans understood that a heavily indebted government ceded control of that government to its creditors, who could very well be foreign governments or others with ill intentions toward the US.

Veto-proof Democrat control of Congress beginning in 1955 changed all that, as the socialism inherent in Democrat domestic politics resulted in massive spending programs, such as Lyndon Johnson’s Great Society. The Democrats’ political tactics evolved into “pay for play” (a way to milk campaign dollars for donors interested getting favorable legislation passed) and “tax-and-spend” (a way to buy votes by bringing home the bacon – never mind the pass-through costs to taxpayers!).

The problem for the Democrats was the long-standing congressional appropriations process and a teeny tiny constitutional power granted to the president to withhold spending.

Until 1974, spending was controlled by congressional votes on separate bills that concerned specific appropriations, revenues, and authorizations – generally developed by the congressional committees responsible for funding and oversight of specific cabinet departments and agencies, such as Defense, Health and Human Services, Labor, etc. The process empowered committee chairmen while providing for public scrutiny to all appropriations bills, but the Democrats had pretty much free reign to spend during the 1960s because they controlled Congress and the presidency until 1969.

However, presidential impoundment was also an impediment to profligate congressional spending, and this is the weapon that President Nixon employed to curtail some of the Democrats’ profligacy. As noted here, presidential impoundment is the refusal of the chief executive to expend funds appropriated by Congress. President Thomas Jefferson was the first president to impound funds, and many others chose to use that power until Congress passed the Congressional Budget and Impoundment Control Act of 1974 over the veto of the Watergate-weakened Nixon.

These are the key elements of the Act: to establish a new congressional budget process; to establish Committees on the Budget in each House; to establish a Congressional Budget Office; to establish a procedure providing congressional control over the impoundment of funds by the executive branch.

In short, the Act was a structural change to the budgeting process that diluted the power of congressional committee chairmen, curtailed the constitutionally granted impoundment authority of the president, and established a staff bureaucracy (the CBO). The newly created CBO was a particularly important cog in the revised appropriations process wheel. The Congressional Budget Office was charged under the Act with impartially gathering data and making estimates, that is, placing a financial “score” on any proposed legislation that effected the budget-making process. The CBO was staffed proportionally by party line. As Democrats controlled Congress prior to the “Gingrich revolution” in 1994, the CBO became dominated by Keynesian economists who favored deficit spending to “stimulate the economy.” Not a surprise, as this was one element of the Democrats’ political tactic of “rule by the experts” (as long as they got to choose the experts!). The totality of these measures completely opened the door for deficit spending and other spending maneuvers that bloated the federal budgets over the years.

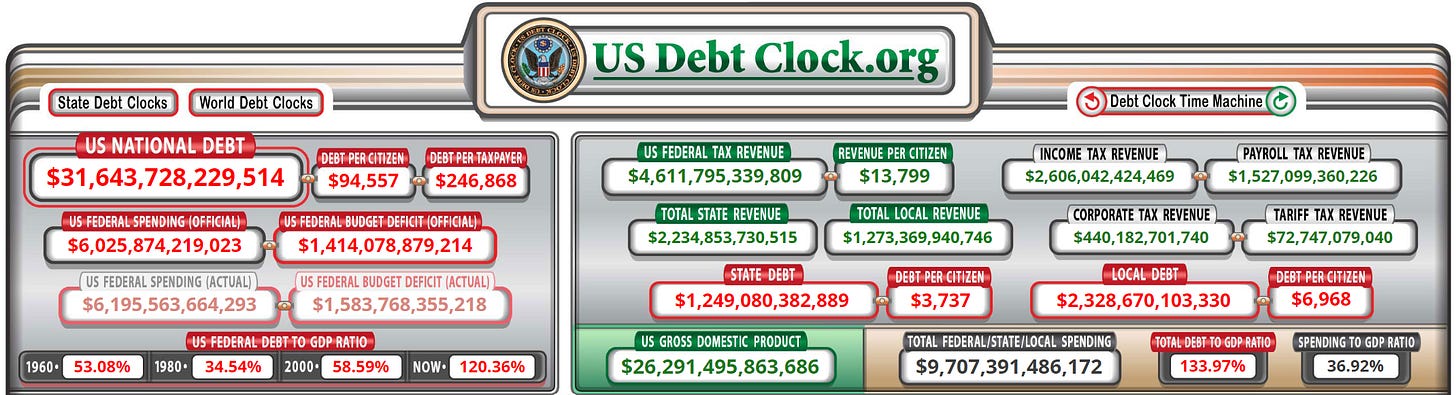

Consider the results, as the graph from the US Treasury here shows, federal debt has grown exponentially since the Act was passed (it took a couple of years for the kinks to be worked out and the skids greased). The Act and all that ensued since its passage have directly led to the current $31.64+ trillion national debt. Oddly enough, the US debt clock hasn’t registered the $1.7 trillion omnibus appropriations bill that had fiscally conservative Republicans and others so incensed during the speakership battle. Just like the rate of inflation has not yet been impacted by that gargantuan spending bill (it takes at least 7-10 months for the inflationary effects of a bill that size to be felt in the US economy).

WHAT TO DO?

Real structural changes are required in Congress’s appropriations process – and not the kind that can be easily undone or corrupted by future Democrat speakers of the House. History has shown that the root cause of the out-of-control spending is the Congressional Budget and Impoundment Control Act of 1974.

The deal mentioned above that includes rule changes that target reducing spending and making it more politically difficult to increase the debt ceiling is a step in the right direction, but it is not a structural change to the appropriations process that carries the force of law that can last over time (and be politically difficult for subsequent congresses to change!).

The 1974 Act must be repealed, the CBO disestablished, and power restored to committee chairmen to fund and oversee specific federal departments and agencies. A return to regular order and regular budgets will remove some of the power of the speakership by empowering the committee chairmen, just as the practice had existed from 1781 through 1974. The American people will have much better insight and ability to scrutinize appropriations bills by bringing to the end 4000-page omnibus bills that include non-budgetary items that would not be passed into law if deliberated separately, as well as put maximum pressure on Congress to balance the federal budget.

It is long past time to deal with the root cause of out-of-control deficit spending rather than dealing with a few symptoms of the real problem To not do so immediately risks a sovereign debt crisis and a disaster for the country. And that is exactly the direction, as the Chinese yuan may replace the US dollar in oil trading, as some have predicted. If that happens, say “hello” to Argentina-style economic collapse.

The end.

You're of course absolutely correct but the out of control helicoptering of trillions in fairy dust money will only accelerate. The communists now make elections pointless so even if there was a massive general awakening, the vote counters would make sure to keep us irrelevant.

Buckle up.